Banks and savings institutions insured by the Federal Deposit Insurance Corp. (FDIC) saw second-quarter net income rise 25.1 percent over the same period last year, and margins remained strong, according to data released by the agency Thursday. Even so, the deposit insurer’s new chairman, Jelena McWllliams, cautioned the industry to be ready for economic challenges ahead.

“The banking industry experienced continued improvement in net interest income, noninterest income and loan performance this quarter. However, the interest-rate environment coupled with competitive lending conditions have led to heightened exposure to interest-rate, liquidity, and credit risks. The industry must continue to position itself to be resilient through economic cycles,” McWilliams said in a statement issued with Thursday’s Quarterly Banking Profile (QBP) for the second quarter.

FDIC attributed earnings growth to higher net interest income and a lower effective tax rate.

Highlights from the second-quarter QBP show:

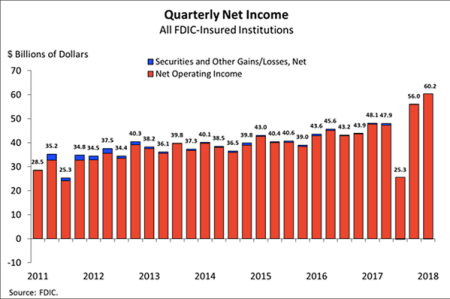

- FDIC-insured institutions reported $60.2 billion in quarterly net income, up $12.1 billion (25.1%) from a year ago.

- Loan and lease balances rose $104.3 billion (1.1%) from 1Q 2018. Balances grew by 4.2% over the past 12 months, down from the 4.9% annual growth reported for 1Q 2018.

- Average return on assets (ROA) increased to 1.37%, up from 1.13% in 2Q 2017.

- Net interest income was $134.1 billion, up $10.7 billion (8.7%) from a year ago and the largest annual dollar increase ever reported by the industry. More than four out of five banks (85.1%) reported improvement from a year ago, FDIC said.

- The average net interest margin increased to 3.38% from 3.22% in the second quarter of 2017.

- Noninterest income was $68.1 billion, up $1.3 billion (2%) from 2Q 2017.

Of the 5,542 insured institutions reporting second-quarter financial results, more than 70% reported year-over-year growth in quarterly earnings, the FDIC said. The percent of unprofitable banks in the second quarter declined to 3.8% from 4.3% a year ago.

The FDIC reported that total problem banks declined during the quarter from 92 to 82, the lowest number since 4Q 2007. Total problem-bank assets declined from $56.4 billion in the first quarter to $54.4 billion. Mergers absorbed 64 institutions, two new charters were opened, and no banks failed.

The FDIC Deposit Insurance Fund (DIF) reserve ratio rose to 1.33%, up from 1.3% during the first quarter. The fund balance grew $2.5 billion in the second quarter to a total of $97.6 billion, driven by assessment income. Estimated insured deposits grew 0.3% from the last quarter and 4.5% from a year ago, the FDIC said.

“The banking industry once again reported positive results for the quarter,” McWilliams said. “Net income rose through higher net interest income as well as noninterest income. Loan growth was experienced in all major loan portfolios, while loan performance continues to improve. Lastly the number of ‘problem banks’ continued to fall. Community banks also reported a solid quarter with loan growth and a net interest margin that exceed the overall industry.”

She added, “It is worth noting that the current economic expansion is the second longest on record, and the nation’s banks are stronger as a result. The competition to attract loan customers will be intense, and it will remain important for banks to maintain their underwriting discipline and credit standards.”

Chairman Jelena McWilliams’ Opening Statement on Second Quarter 2018 Quarterly Banking Profile (Aug. 23, 2018)

McWilliams Press Conference (Video)

FDIC-Insured Institutions Reported $60.2 Billion in Second Quarter 2018; Community Bank Net Income Increases to $6.5 Billion (Press release)